👋 Hello friends,

Thank you for joining this week's edition of Brainwaves. I'm Drew Jackson, and today we're exploring:

Linear vs. Exponential Thinking Patterns & Blindspots

Key Question: How does our deeply ingrained linear understanding of the world blind us to the accelerating exponential realities that increasingly define our modern existence?

Thesis: Our education prioritizes viewing the world in a primarily linear fashion, with linear mechanics driving the majority of outputs and outcomes. This emphasis on linearity has exposed our society to the drastic effects (whether positive or negative) of nonlinear occurrences (those outliers which are outside our linear models—but which conform to exponential patterns). Contrary to our current views of the world (the ways we were taught), it’s much safer to assume things are exponential than linear.

Credit Conde Nast Traveler

Before we begin: Brainwaves arrives in your inbox every other Wednesday, exploring venture capital, economics, space, energy, intellectual property, philosophy, and beyond. I write as a curious explorer rather than an expert, and I value your insights and perspectives on each subject.

Time to Read: 34 minutes.

Let’s dive in!

An old woman was sweeping her house, and she found a little crooked sixpence. "What," said she, "shall I do with this little sixpence? I will go to market, and buy a little pig."

As she was coming home, she came to a stile. But the piggy wouldn't go over the stile.

She went a little further, and she met a dog. So she said to him, "Dog! Dog! Bite pig. Piggy won't go over the stile; and I shan't get home tonight." But the dog wouldn't.

She went a little further, and she met a stick. So she said, "Stick! Stick! Beat dog! Dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight." But the stick wouldn't.

She went a little further, and she met a fire. So she said, "Fire! Fire! Burn stick. Stick won't beat dog; dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight." But the fire wouldn't.

She went a little further, and she met some water. So she said, "Water! Water! Quench fire. Fire won't burn stick; stick won't beat dog; dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight." But the water wouldn't.

She went a little further, and she met an ox. So she said, "Ox! Ox! Drink water. Water won't quench fire; fire won't burn stick; stick won't beat dog; dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight." But the ox wouldn't. She went a little further and she met a butcher. So she said, "Butcher! Butcher! Kill ox. Ox won't drink water; water won't quench fire; fire won't burn stick; stick won't beat dog; dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight." But the butcher wouldn't.

She went a little further, and she met a rope. So she said, "Rope! Rope! Hang butcher. Butcher won't kill ox; ox won't drink water; water won't quench fire; fire won't burn stick; stick won't beat dog; dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight." But the rope wouldn't.

She went a little further, and she met a rat. So she said, "Rat! Rat! Gnaw rope. Rope won't hang butcher, butcher won't kill ox; ox won't drink water; water won't quench fire; fire won't burn stick; stick won't beat dog; dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight." But the rat wouldn't.

She went a little further, and she met a cat. So she said, "Cat! Cat! Kill rat. Rat won't gnaw rope; rope won't hang butcher; butcher won't kill ox; ox won't drink water; water won't quench fire; fire won't burn stick; stick won't beat dog; dog won't bite pig; piggy won't get over the stile; and I shan't get home tonight."

But the cat said to her, "If you will go to yonder cow, and fetch me a saucer of milk, I will kill the rat." So away went the old woman to the cow.

But the cow said to her, "If you will go to yonder haystack, and fetch me a handful of hay, I'll give you the milk." So away went the old woman to the hay-stack; and she brought the hay to the cow.

As soon as the cow had eaten the hay, she gave the old woman the milk; and away she went with it in a saucer to the cat.

As soon as the cat had lapped up the milk, the cat began to kill the rat; the rat began to gnaw the rope; the rope began to hang the butcher; the butcher began to kill the ox; the ox began to drink the water; the water began to quench the fire; the fire began to burn the stick; the stick began to beat the dog; the dog began to bite the pig; the little pig in a fright jumped over the stile; and so the old woman got home that night.

- Old Oral Fairy Tale, Unknown (before 1800)

The future actively shapes our lives. Historically, the way humans have thought about and approached the future has been flawed. Futures Thinking is a modern approach to the future, rethinking how humans think about and approach the future.

Rather than trying to predict specific future events, Futures Thinking encourages a shift in how we conceptualize the future itself—drawing on diverse cultural perspectives, foundational world characteristics, deep modern literature reviews, and recognizing that our present actions and narratives significantly influence future outcomes. Since most major life decisions are essentially bets on the future, adopting this framework could transform how we approach education, careers, relationships, and other essential aspects of life.

Today, our discussion revolves around how our world is set up and how these underlying characteristics shape everything that goes on in the world, specifically focusing on Futures Thinking Tenet #3: The world progresses exponentially rather than linearly.

Credit Strategic Partnerships

SCHOOL CURRICULUMS SHAPE THE WAY WE SEE THE WORLD - A LARGE BLINDSPOT IN OUR UNDERSTANDING - INTRODUCTION TO LINEARLAND AND EXPONENTLAND

As I’m writing this, I’m getting ready to graduate from college and move on from all of my formal education. It’s wild to think that I’ve been in some sort of formalized school for the last ~16 years of my life—that’s a lot of school.

It’s been a season of looking back on where I’ve been throughout those years and how I’ve grown and developed. And I think there are some nice parallels to what you and I learned in school and how that has shaped how we see the world.

Now, this isn’t a full discussion of nature vs. nurture, mind you, but it is an example of how we learn to think about the world in a simple, utopian view, which isn’t how it works in the “real world.”

If you were like me, you started learning numbers pretty much as soon as you could learn. I probably learned how to count to ten before I was 3 or 4. From there, you learned how to count a bit higher, getting into the 11-20+ range.

Now, with a decent base of numbers you could use, you generally began understanding counting and identifying numbers in the wild. For instance, your parent might have put a pile of Cheerios in front of you and asked you how many there were (and you would count them one by one).

Getting into kindergarten and first grade, you were introduced to the concepts of addition and subtraction—the core idea that numbers can interact with each other using operators to form other numbers.

In 3rd-4th grade, you learn the concepts of multiplication and division (usually by putting a pile of Cheerios into smaller piles and seeing how many smaller piles there were). You started to work with bigger numbers, triple and quadruple digits.

And that became the foundation of your math knowledge, the core 4 operators: addition, subtraction, multiplication, and division. On the surface, you probably wouldn’t say anything is wrong with teaching math this way, and I would agree with you. It’s a great foundation; however, it doesn’t perfectly mirror how the world actually works.

You probably didn’t realize it, but in 5th and 6th grade, you learned one of the coolest properties of math and the unappreciated “secret” to the world: exponents. In practice, they aren’t complicated since they can be broken down into multiplication and division (e.g., 5^3 = 5 * 5 * 5), so you probably didn’t grasp the true power of the knowledge you were just bestowed with.

The rest of your education followed this pattern, where ~90% of your time was spent understanding things in a practical, easy fashion (a linear fashion), and the other ~10% was spent on exponential matters.

You probably didn’t realize this; there are thousands of examples showcasing this fact that I could offer. For instance, the fundamental graphing equation is linear: Y = Mx + B. Even in other disciplines, this emphasis on linearity is present. For instance, in science (specifically physics), Newton’s Second Law—every action has an equal and opposite reaction—is simply a linearity.

For me, it wasn’t until I hit Calculus (mainly a college-level course) that our discussions (and my learnings within the class) became more focused on exponentials than linearities, so for me, that was after ~10 years of my schooling, when I was around 16.

If you ever took Calculus, you still probably remember the song “X = -B +/- the square root of B^2 - 4*A*C divided by 2*A” (if you don’t know the song or don’t remember it, you’re missing out on some prime childhood nostalgia). Welcome to the complexities of nonlinearities.

The reason for this breakdown (majorly linear, minorly exponential) in the way we are taught is, in my opinion, due to the simplicity of thought. It’s much easier to think linearly rather than exponentially. For sane individuals, easier equations are always preferred to complicated ones—in calculus, we would love to turn an exponential equation into a linear one using a derivative.

It’s due to this that we’ve come to expect the world will be majorly linear. Such that when we do a pushup, we expect to be exactly that much stronger every time (i.e., you’ll get the same benefit from your 10th pushup as your 910th pushup). But, in the real world this isn’t always the case.

Again, this isn’t to say that learning about or thinking in linearities is bad by any means; it just doesn’t accurately represent the world we live in, however much we would like to argue otherwise.

Today, my goal is to convince you of this fact, specifically, that the world progresses exponentially rather than linearly.

I was first formally introduced to this idea through Nicholas Taleb’s Black Swan book. In it, he sets up two different sets of “sub-worlds” which coexist in our world: Extremistan and Mediocristand, which today, for ease of your understanding, we’ll call Exponentland and Linearland. The difference between the two is that in Exponentland, observations and properties of the world are such that one single observation can disproportionately impact the aggregate, whereas those that belong to Linearland are not skewed due to outliers (as there are none). In other words, those things belonging to Linearland are linear (subject to normal distributions), and those things belonging to Exponentland are exponential (subject to skews and outliers).

It may be easier to explain through examples. The following matters belong to Linearland: height; weight; calorie consumption; income for a baker, a small restaurant owner, a prostitute, or an orthodontist; gambling profits (in the very special case, assuming the person goes to a casino and maintains a constant betting size); car accident; mortality rates; and “IQ” (as measured).

Take height, for example. As currently surveyed, the average male height globally is 5’7”, and the average female height globally is 5’3”. However, to showcase the differences between Linearland and Exponentland, we don’t care about the average in these scenarios; we care about the range from the absolute minimum observation to the absolute maximum observation (including outliers). For height, there is an obvious lower bound at 0’0” (to our knowledge, thus far, it’s a fact of the universe that you cannot have negative height as a human). For the upper bounds, the tallest verified human has been 8’11”.

Expressly put, you don’t go around seeing someone that’s 100 feet tall or even 20 feet tall—those extreme outliers (the ones driven by exponential curves) aren’t present in this distribution. To be clear, height in a population is normally distributed (think elementary normal bell curve), meaning that if you were looking for men taller than 7’4”, you’ll perhaps find one every 1 billion people; a normal curve drops off sharply as you move away from its mean. As such, height is a matter designated by Linearland.

The following matters belong to Exponentland: wealth; income; book sales per author; book citations per author; name recognition as a “celebrity”; number of references on Google; populations of cities; uses of words in a vocabulary; numbers of speakers per language; damage caused by earthquakes; deaths in war; deaths from terrorist incidents; sizes of planets; sizes of companies; stock ownership in public companies; height between species (consider elephants and mice); financial markets; commodity prices; inflation rates; and economic data.

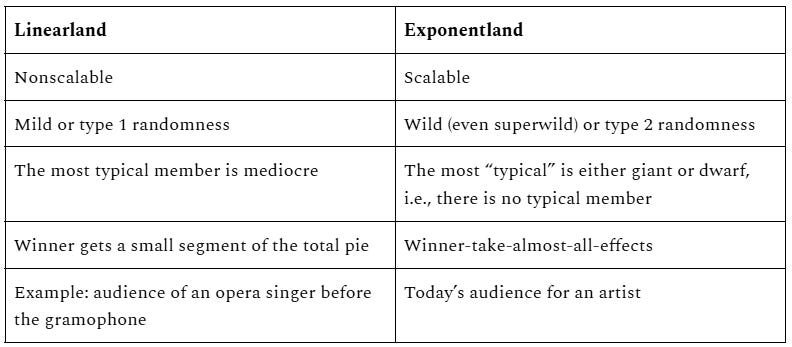

In his book, Taleb details the following set of criteria to distinguish between the two realms (explained through the following 3 pictures):

Linearland, a world primarily dominated by normal distributions, is well-understood and easy to work with. This is why it is the first “world” we are taught about in school and why our education primarily focuses on the properties and components of things contained in this world.

One of my favorite properties of Linearland and these normal distributions is the Law of Large Numbers. The Law of Large Numbers comes from probability theory, stating that the average of the results obtained from a large number of independent random samples converges to the true value for the whole.

Amar Bhide, in his new book, Uncertainty and Enterprise: Venturing Beyond the Known, writes, “With questions about statistical distributions, more of the same kind of data produces more confidence, while less data increases doubt.”

In a linear world, the Law of Large Numbers holds well—more samples translate directly to convergence to the true value for the population. However, in an exponential world, this Law falls apart easily.

Consider the example of a turkey. It lives on a farm for the first 1000 days of its life without accident, eating and surviving well. If this were Linearland—meaning The Law of Large Numbers and normal distributions applied—we would assume (actually we would be almost certain) that day 1001 would continue the same trend. However, if this were Exponentland, we wouldn’t be certain of anything, needing to consider whether or not the next day(s) included Thanksgiving (in this case, Thanksgiving would be an exponential outlier given our 1000 days of historical data).

Jerry Neumann, writing in his publication Reaction Wheel, states:

The professors who live by the bell curve [the normal distribution] adopted it for mathematical convenience, not realism. It asserts that when you measure the world, the numbers that result hover around the mediocre; big departures from the mean are so rare that their effect is negligible. This focus on averages works well with everyday physical variables such as height and weight, but not when it comes to finance. One can disregard the odds of a person’s being miles tall or tons heavy, but similarly excessive observations can never be ruled out in economic life…In other words, we live in a world of winner-take-all extreme concentration. Similarly, a very small number of days accounts for the bulk of stock market movements: Just ten trading days can represent half the returns of a decade.

As Jerry implies, not everything is normally distributed; other processes can lead to other distributions (following exponential power laws). He offers some examples of these exponential power laws in real life (with their associated alphas in parentheses):

Intensity of wars (A = 1.8)

Solar flare intensity (A = 1.8)

Frequency of use of words (A = 2.2)

Population of U.S. cities (A = 2.3)

Magnitude of earthquakes (A = 3.1)

Email address book size (A = 3.5)

Sales of books (A = 3.7)

Papers authored (A = 4.3)

Now, to clarify, the world we currently live in isn’t completely dominated by Linearland or by Exponentland; it’s a mix of both. However, as Taleb touches on in his table, the composition has been changing over time, straying away from Linearland and towards Exponentland. To be clear, there are still linear things present in life (see the list of examples above), but there is an increasing percentage of exponential things present in life.

To summarize the above into a concise statement, humans have been taught to think primarily linearly compared to exponentially. Given that the world is a mix of characteristics of Linearland and Exponentland, our upbringings have made it easier to understand the linear portion of the world, but have left us vulnerable to missing the characteristics and properties of the world that follow exponential factors. Understanding these factors and properties of the world is key to building a proper foundation of thought for Futures Thinking.

The world is more nonlinear than we think.

Credit Capgemini

EXTRAPOLATING FROM THE PAST DRIVES A NEW “LAW” OF TECHNOLOGY - SOLAR PANELS ARE SIMULTANEOUSLY LINEAR AND EXPONENTIAL - ANY NUMBER OF CURVES CAN FIT THE DATA

In some ways, the world is beginning to recognize the world’s exponentiality, usually via smart scientists in niche subsectors.

Gordon Moore was born in 1929 and grew up in California. In 1940, when he was 11, he received a chemistry set for Christmas, which sparked his love and lifelong obsession with chemistry. He attended San Jose State College for 2 years before transferring to U.C. Berkeley, where he graduated with a Bachelor of Science degree in chemistry. From there, he received his Ph.D. in chemistry from Caltech in 1954.

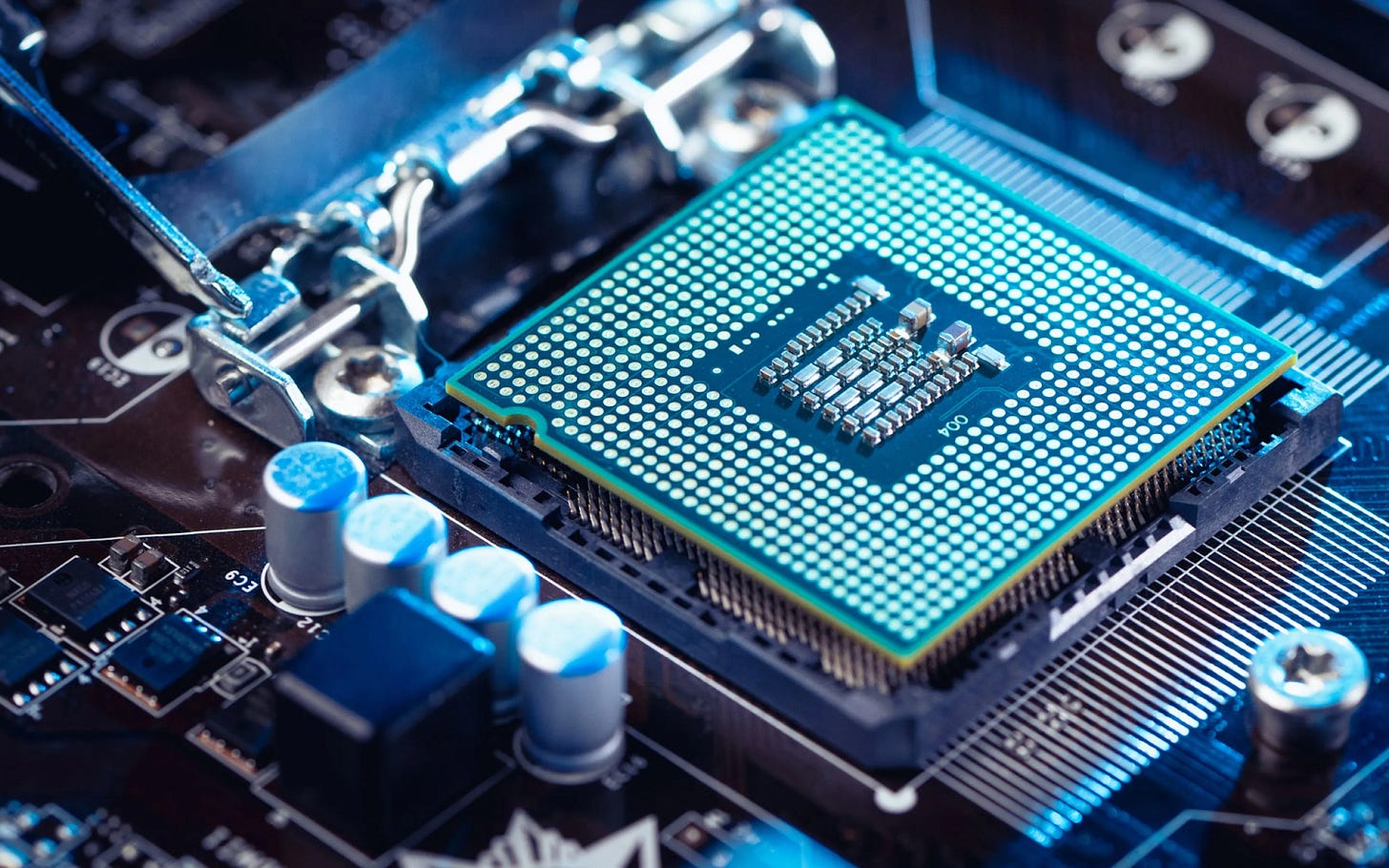

Moore began at the Shockley Semiconductor Laboratory division of Beckman Instruments but left when Sherman Fairchild created the Fairchild Semiconductor corporation. In 1965, Moore was working as the Director of R&D and was asked by Electronics Magazine to predict what he thought might happen in the semiconductor components industry over the next 10 years.

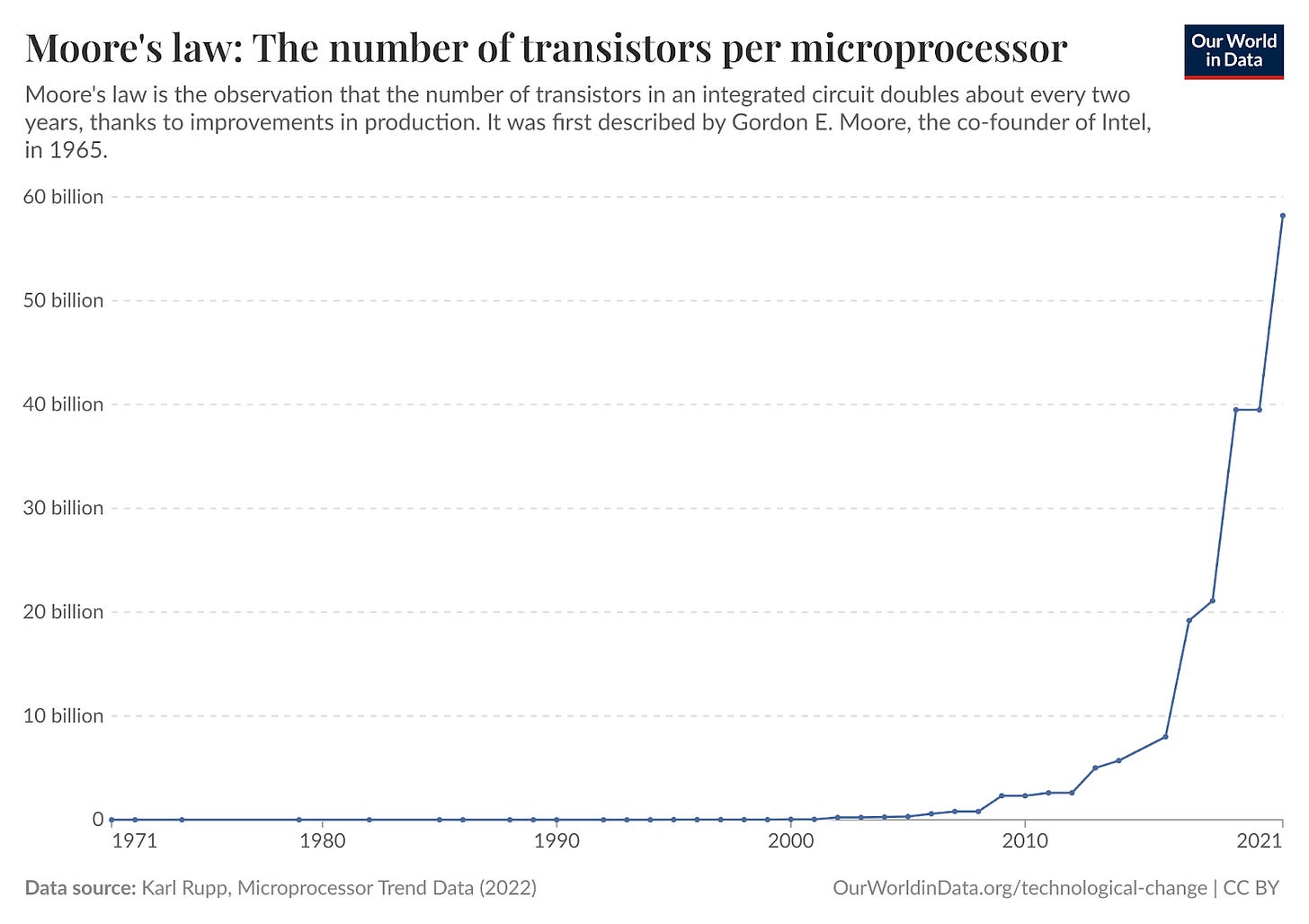

Moore observed that the number of components (transistors, resistors, diodes, or capacitors) in a dense integrated circuit had doubled approximately every year and speculated that it would continue to do so for at least the next 10 years. In 1975, he revised the forecast rate to approximately every 2 years, coining the term “Moore’s Law”.

Moore’s law, the simple thought that the number of transistors on a chip will double roughly every 2 years with a minimal increase in cost, has become the “golden rule of technology.” To clarify, Moore’s Law is not a true law of nature, but an observation of a long-term trend in how a specific technology was changing.

The chart below shows Moore’s original graph he drew in 1965 to describe this phenomenon, although at the time he only had a few data points:

Credit Our World In Data

Moore’s Law has held true for over 50 years, as shown in the chart below:

Credit Our World In Data

Now, this graph looks linear (since it’s a logarithmic scale, but when you plot it on a simple chart, it looks heavily exponential:

Credit Our World In Data

Moore’s law is one of the most famous examples of a long-term exponential phenomenon in our world, but there are many other examples of this in the realm of computers and beyond.

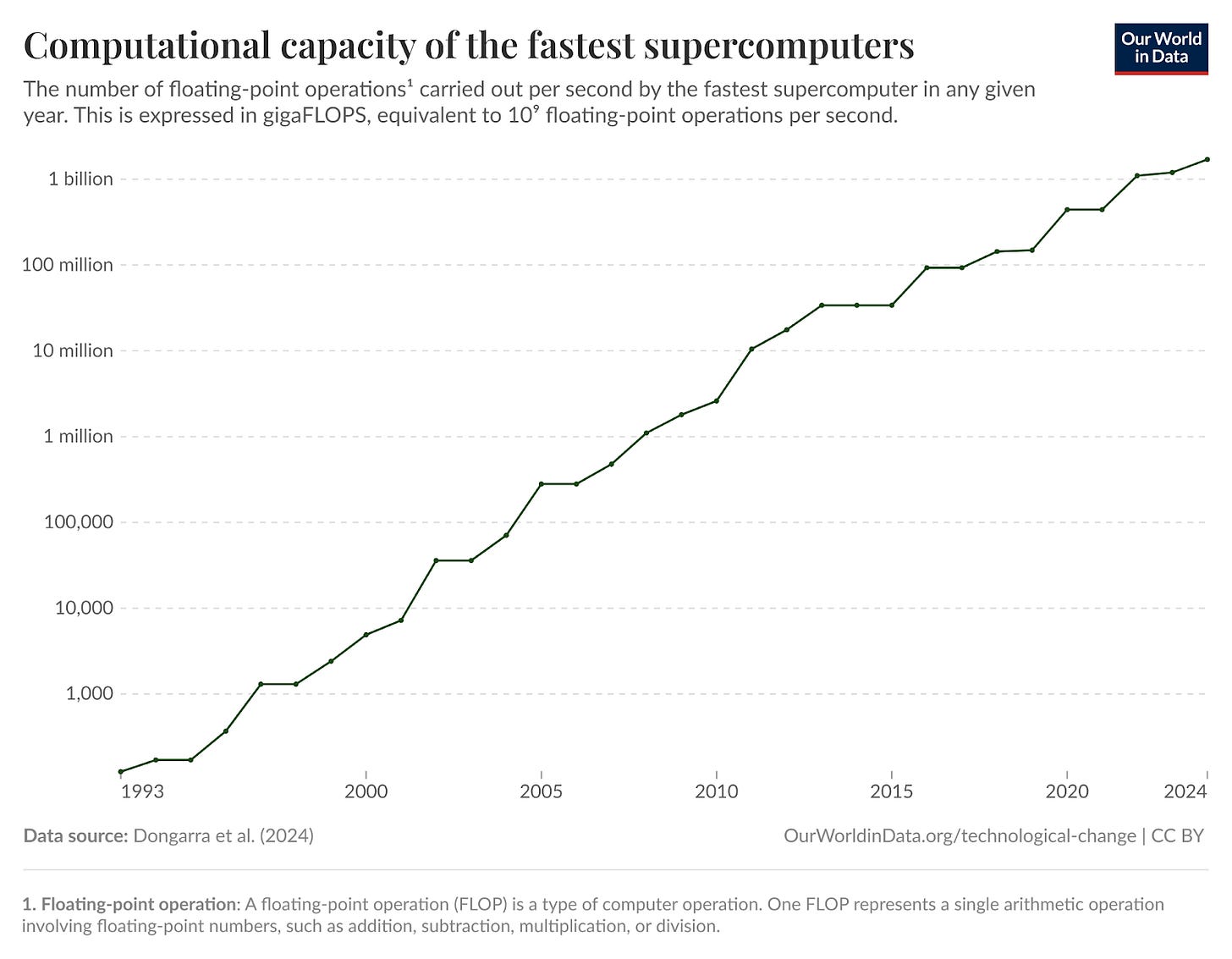

For instance, the computational capacity of computers has doubled every 1.5 years, measured in FLOPS ( the number of computations the machine can carry out per second).

Credit Our World In Data

There are many other examples of these exponential curves in our lives: global electricity use since the Industrial Revolution, the rise and quick fall of NFTs, stock market rises and crashes, the mechanics of the popular phone game 2048, lawsuit payments, the volume of information in the world over time, measurements in the metric system, etc.

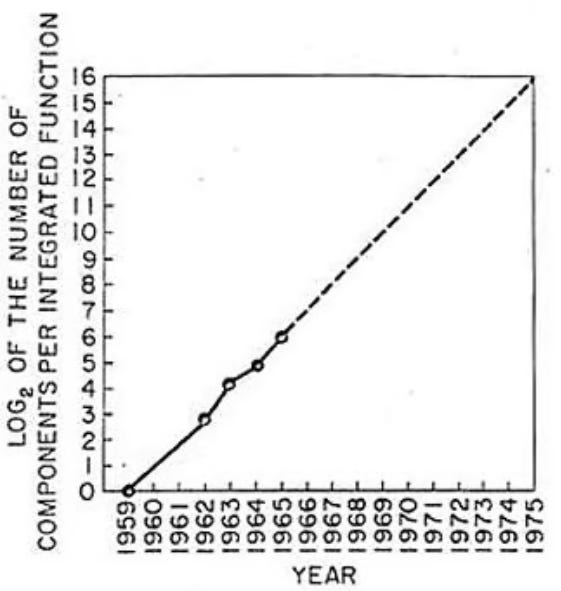

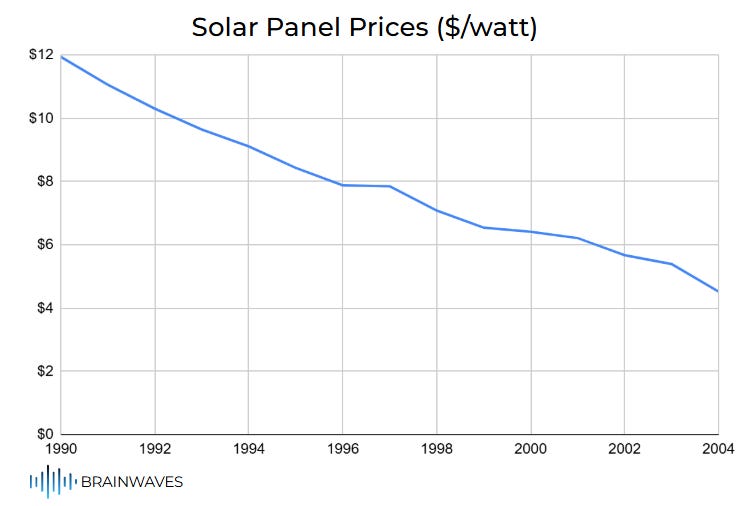

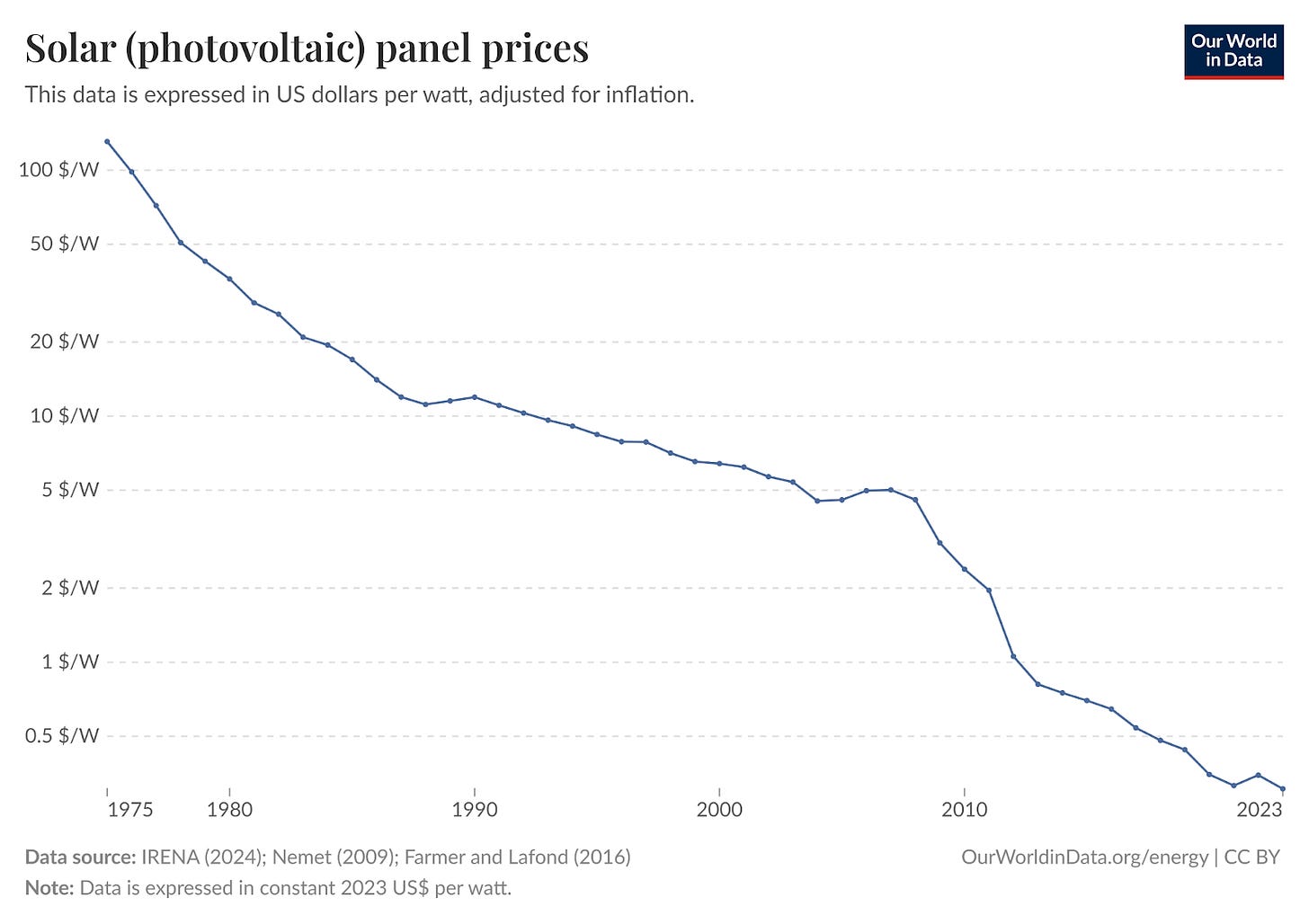

Bringing us full circle, these curves are exponential over the long term; in these examples, the exponentiality is witnessed on the time scale of decades or centuries. However, when you zoom in a slight bit (into the progression by day, month, year, etc.), many periods on these curves could easily be mistaken as linear. A good example of this is the price of solar panels over time:

When you zoom into the period from 1990 to 2004 (shown above), the declining price looks very linear, when in fact it’s part of a much greater exponential curve (shown below):

Credit Our World In Data

As you can see, it’s quite easy to mistake something linear for something exponential and vice versa. As Taleb puts it in his book, “the linear model is unique. There is one and only one straight line that can project from a series of points. But it can get trickier. If you do not limit yourself to a straight line, you find that there is a huge family of curves that can do the job of connecting the dots.”

As we’ve seen, an exponential curve can often look linear, yet when you finally have enough context to see the big picture, you can witness the exponential properties of the distribution. As such, something that looks unlikely in a linear distribution (it would be considered a large-scale outlier and/or it would be considered “impossible” to occur) could actually be probable in an exponential distribution (it would be just another point on the curve).

In most, if not all cases, it’s safer to assume exponentiality instead of linearity.

Credit Medium

LESSONS YOU MISSED FROM THE 1800 PRESIDENTIAL RACE - WHY DO SO MANY PEOPLE PLAY THE LOTTERY - ARTICULATING THE DIMINISHING VALUE OF THE “AMERICAN DREAM”

The United States' founding fathers are often praised for their ability to set up a method of governance capable of managing such a large and complex country. Arguably, one of the oversights, which has now been fixed, was the system in which vice presidents were chosen.

In 1776, citizens of the states around the country would vote for who they were interested in becoming president. In turn, electors from those states would cast votes on behalf of the broader citizen demand. This was, and continues to be, the system for how the president of the United States is chosen.

Originally, the system for choosing a vice president was simple: whoever was the runner-up (2nd place) for president would become the vice president. This lasted for a couple of cycles before the election of 1800 resulted in a tie (for the vice-president race), necessitating the House of Representatives to decide (via the system outlined in the Constitution).

Soon after, the states ratified the 12th Amendment, signifying separate races for president and vice president. Today, the president and vice president candidates run together as a package, where you can choose to elect both or neither.

This historical example (that you’ve probably never heard of) helps showcase how ingrained some of the properties of Exponentland have become into our societies, touching the spheres of economics, politics, social order, geography, and many more. If you’re confused at how this is an Exponential matter, don’t worry, I’ll explain.

Recently, I had the chance to travel to London to view all of the touristy things there—side note: incredibly worth it, would recommend. In visiting the various museums, galleries, and famous places, many of them had the following inscription near the entrance: “Lottery Funded”.

From my quick research, it seems as though they have these “community lotteries” running quite often throughout the U.K. where players can buy tickets to participate (to try to win money from the lottery), and a portion of their ticket goes to funding public works/arts/social projects.

What’s the connection between the vice president of the United States and U.K. community-funded lottery projects?

The example of the lottery is a classic, as it’s clearly a matter belonging to Exponentland. Outcomes in the lottery are exponential; the biggest prize can, in theory, be infinite (or highly exponentially driven). The key attribute of lottery exponentialism to highlight here, and what makes them so popular to play, is the concept of winner-takes-all.

An exponential world promotes a winner-take-all ecology (or, as Taleb puts it, a winner-takes-almost-all ecology), where one entry, one person, or one thing skews the entire sample, and that’s why many of us play.

Relating back to our seemingly bizarre example above, in the 21st century, American politics is much more of a winner-takes-all system. Instead of the vice president being the runner up—who was often of the opposite political party to the president and, as such, could continue to be an issue to their political agenda (this was one of the main reasons for the change)—the vice presidency is also now subject to winner-take-all effects, where the party that wins the presidency also wins the vice presidency (literally winning all the powerful positions).

America is a society built on this ecology, down to our initial founding roots. What brought many people here in the first place was the promise of the “American Dream”, an ideology that suggests anyone, regardless of background, can achieve success and a better life through hard work and determination.

This is the “land of opportunity.” But opportunity for what? When you boil it down, it’s the opportunity to win, and in many cases, the opportunity to win it all. You’re probably familiar with the few “winners” throughout American history thus far—they are the ones with their names everywhere: Rockefeller, Bezos, Rothschild, DuPont, Musk, Trump, etc.

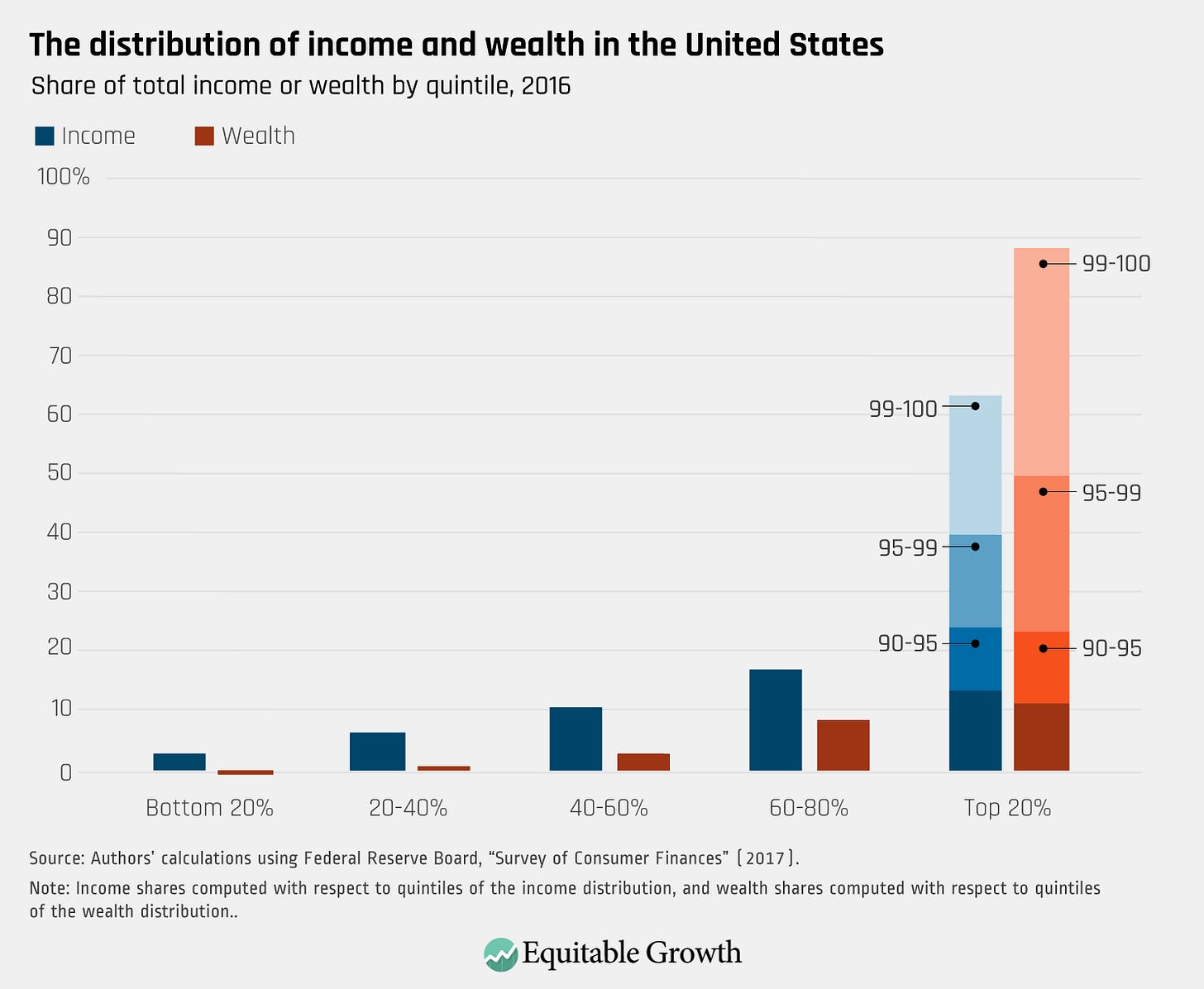

A simple look at the concentration of wealth in America justifies this claim:

Credit Equitable Growth

It’s an approximation, but the top 1% (the all-out winners) control around 40% of the nation’s wealth. The top 10% control around 70% of the nation’s wealth—a clear example of winners taking all.

Due to this fact, Taleb gives the following career advice:

If I myself had to give advice, I would recommend someone pick a profession that is not scalable! A scalable profession is good only if you are successful; they are more competitive, produce monstrous inequalities, and far more random, with huge disparities between efforts and rewards—a few can take a large share of the pie, leaving others out entirely at no fault of their own… Some professions, such as dentists, consultants, or massage professionals, cannot be scaled: there is a cap on the number of patients or clients you can see in a given period of time… In these professions, no matter how highly paid, your income is subject to gravity. Your revenue depends on your continuous efforts more than on the quality of your decisions. Moreover, this kind of work is largely predictable: it will vary, but not to the point of making the income of a single day more significant than that of the rest of your life.

In some scenarios, this winner-take-all property of exponential systems can theoretically continue on forever—scarily so (e.g., people can get infinitely rich). However, this isn’t always the case. As many exponential factors continue progressing, they begin to experience diminishing marginal returns.

Diminishing marginal returns is an economic property that states that as more and more of an input is added, the marginal product (here meaning the additional output from the added unit of input) will eventually decrease. In simpler terms, it means that at some point, adding more of one resource (e.g., labor, money, time) will lead to smaller and smaller increases in the overall output.

A good example of this would be the power concentration within the United States. Similar to wealth, power is incredibly concentrated in America, generally correlating with the wealth of the individual (i.e., those with more wealth will have more power).

If we take this as fact (i.e., wealth = power), and if we were based in Linearland, we would assume that getting $1 more in wealth would result in receiving that proportion more of power. In Linearland, that would mean getting your 10th dollar would be the same increase in power as getting your 100,000,000th dollar. However, that isn’t the case.

Power and wealth, instead, follow an exponential system, wherein the properties of winner-take-all and diminishing marginal returns both apply. As we’ve shown above, there are intrinsic winner-take-all properties in wealth and power, and as such, there are few that have “won” and now control a majority of the wealth and power in America.

However, the property of diminishing marginal returns, as applied to these winners, states that if they were to gain $1 more in wealth, that would result in a smaller increase in power compared to a person with $10k in wealth gaining $1 in wealth. In other words, your first dollar contributes more to your power than your 10th dollar, than your 100th dollar, than your 100,000th dollar, and so on.

As it currently stands in the United States with our power and wealth concentrations, the American Dream itself has continued to have diminishing marginal returns. Over time, the psychological “power” that ideology contained has dramatically diminished as the number of winners continued to diminish and further concentrate. In other words, it’s much harder now to achieve the American Dream (a common lament of each subsequent generation).

This is an unfortunate, but foreseeable consequence of the exponential system we are a part of.

Credit New Bedford Whaling Museum

EXPONENTIALITY IS A KEY COMPONENT OF NATURE - BOUNDED VS. UNBOUNDED EXPONENTIALITY - REALIZING OUR WORLD IS ON THE KNIFE’S EDGE

Our ancient ancestors, the hunter-gatherers of the world, experienced the winner-take-all property life very literally.

In my recent article, The Vast Competitive Landscape, I discussed this principle (the survival of the fittest) more in-depth, but I’ll summarize it for you here: For hunter-gatherers, those who won survived. In this case, winning usually referred to finding enough food or avoiding the most predators.

The properties of Exponentland can be traced back to the very beginning, even before humans were on Earth. For instance, take the composition of everything in existence. You have protons, neutrons, and electrons, which form atoms, which form molecules, which form elements, which form all matter that exists everywhere. These building blocks of life are highly exponential (e.g., there are exponentially more atoms than molecules).

In the Black Swan, Taleb discusses this property of the world using the example of our diet and exercise routines in the 21st century:

Our ancestors mostly had to face very light stones to lift, mild stressors; once or twice a decade, they encountered the need to lift a huge stone. So where on earth does this idea of “steady” exercise come from? Nobody in the Pleistocene jogged for forty-two minutes three days a week, lifted weights every Tuesday and Friday with a bullying (but otherwise nice) personal trainer, and played tennis at eleven on Saturday mornings. Not hunters. We swung between extremes: we sprinted when chased or when chasing (once in a while in an extremely exerting way), and walked about aimlessly the rest of the time. Marathon running is a modern abomination (particularly when done without emotional stimuli).

Nature (even human nature), at its roots, is a land full of exponential factors.

Consider the size of objects in our universe. If you haven’t seen one of the fantastic montages of the size of different things in the universe, I would recommend watching, as the astronomical differences can be pretty astounding.

At one end, you have smaller planetary bodies and sub-planetary bodies such as meteors and comets. At the other end, you have stars the size of galaxies—a very large disparity in size across the universe.

To amend an earlier statement I made: nature, at its roots, is a land full of exponential factors, bounded by natural limitations. For better or worse (I’ll argue it’s better), nature has placed upper and lower bounds on its exponentiality.

What is the biggest animal ever to exist? The blue whale, a massive sea-bound creature that can grow to be 90 feet in length. It’s the very biggest animal we’ve ever known to exist. On the other end, there are tiny bugs and other creatures no bigger than human hairs. As you can see, there is exponentiality at play here, but it’s bounded. There aren’t animals the size of towns, cities, countries, continents, or planets (emphasizing that there may be an upper limit on the size of animals in nature).

Why? As Taleb puts it, “Mother Nature does not like anything too big. The largest land animal is the elephant, and there is a reason for that. If I went on a rampage and shot an elephant, I might be put in jail, and get yelled at by my mother, but I would hardly disturb the ecology of Mother Nature.”

According to his theory, nature is bounded (whether explicitly or implicitly) in this way for homeostasis, in order to more properly maintain the status quo. If the biggest animal were to die, it wouldn’t upset the fundamental properties of the system, causing exponential ripple effects.

Bounded exponentiality, as witnessed in nature, helps prevent catastrophic events. If the worst came to worst, planets could be disrupted, but, due to the boundaries of nature, the majority of the rest of the universe would be unharmed.

In contrast, the world that humans find themselves in (the one we’ve created for ourselves) exhibits a different form of exponentiality, unbounded exponentiality. A couple of examples of this unbounded exponentiality are below:

In a theoretical sense, there is no natural cap on the amount of money an individual or entity could accumulate within human economic systems. Granted, practical constraints like market size, regulatory frameworks, and the finite resources of the planet exist, but the underlying mechanisms of wealth creation can lead to exponential accumulation without a fixed upper limit imposed by nature itself (i.e., that electronic number in your bank account could theoretically say infinity).

Nature currently limits the human lifespan; however, the trajectory of scientific and technological advancement suggests a potential for “unbounded” extension, where we could theoretically live forever (outpacing our rate of decay through medical science). In their book Ikigai: The Japanese Secret to a Long and Happy Life, Garcia and Miralles explain how the human lifespan has been increasing by 0.3 years for each of the last 100 years, a phenomenon that could one day get to >1, meaning “unlimited life.”

Granted, there are still some things bounded due to natural properties of the world (i.e. the maximum is not infinity or negative infinity): how many people can die, the number of people that can inhabit the Earth, the speed of information transfer, the efficiency of energy conversion, the number of planes flying at one time, the number of cars we can build, the highest number you can count to in your life, how many hotdogs you can eat at one time, etc. The problem with many of these, however bounded, is that the upper limit is still incredibly large and can continue to pose a very similar threat to unbounded exponentiality.

Using Taleb’s framework for analysis, the real issue with unbounded exponentiality is that the right input can theoretically cause unlimited effects throughout the system as it never meets a natural barrier to its progression (via the way the world/system has been set up). Similarly, although bounded, a highly bounded exponential system can experience the same problem.

Taleb uses the example of our monetary system, stating, “on the other hand… if you shot a large bank, I would ‘shiver at the consequences’ and that ‘if one fails, they all fall’--was subsequently illustrated by events: one bank failure, that of Lehman Brothers, in September 2008, brought down the entire edifice.”

Credit Therapytips

DELVING INTO THE TIME DIMENSION - THE PLAGUE OF TIME SICKNESS AFFECTS US ALL - EXTRAPOLATIONS FROM THE PAST

Everyone lives one day at a time.

One constant factor throughout our lives is time, which in turn creates the past, present, and future.

In physics, viewed through Einstein’s concept of relativity, time is considered a dimension, often referred to as the “fourth dimension.” In this context, time is primarily considered a linear factor, meaning it progresses in a single direction at a constant rate, with events occurring in a sequence along this timeline.

Often, we talk about things changing over time, with effects being linear or exponential. For example, if you earn $10/hour, the total amount you earn increases linearly with the number of hours you work, an example of linear time.

In contrast, I recently wrote about the concept of exponential personal growth over time through The Power of 1% framework. In this case, time can be used to propagate positive (and negative) effects, emphasizing the concept of compounding to create outsized returns.

However, even time itself at a fundamental level has started to feel exponential.

Larry Dossey, an American author and physician, coined the term “time sickness” in his 1982 book Space, Time & Medicine, defining it as the belief that many people have about the fact that time is always slipping away, that there is never enough of it, and that we must go faster and faster to keep up. If you’ve ever felt crushed by the sheer amount that needs to be done in your life, you’ve probably experienced time sickness.

Similarly, others have theorized that our perception of time might not be linear. As we age, a year represents a smaller fraction of our total life experience, which could lead to the relative feeling that time is passing more quickly.

Integrating the concepts of past, present, and future only increases the potential exponentiality of time. Similar to the ideas presented above, if you zoom into life wherein we live it, speaking here solely about the present moment, life and everything in it looks linear.

Include and extrapolate from the past or the future, and anything comes into play, whether linear or any manner of exponential.

Depending on what you learned in school, you probably have varying viewpoints on this extrapolation, primarily driven by your history teachers. The key question at hand: Does history repeat itself?

If we were to consider a truly linear model of history being a 1:1 model of the future, then things that happened in the past will happen again in the future. Any normal person would immediately be skeptical about that.

A slight variation on this thought would be the commonly attributed (but falsely) quote to Mark Twain, “History does not repeat itself, but it often rhymes.” This view makes much more sense, as there are similar patterns and trends that emerge throughout history.

Many of these are due to human nature, with its consistent motivations, emotions, and behaviors, which often lead to similar patterns and themes across different eras: power dynamics, economic cycles, social unrest, conflict and war, and technological disruption.

Through linear thinking, history seems to have direct, imperfect echoes, comprising predictable patterns within a margin of error.

Approaching this quandary through an exponential lens tells a slightly different, scarier story. For instance, instead of faint echoes or “rhymes”, repetitions of the past may become larger and potentially more impactful at an increasing rate. Mistakes of the past could return with amplified force due to technological advancements or interconnected global systems. Exponential effects can create entirely new scenarios that nonetheless bear the hallmarks of past challenges.

What once took centuries to unfold might now happen in decades or years. If history repeats itself exponentially, there may be a compression of historical cycles. The pace of change makes the risk of repeating mistakes with far greater impact much higher.

This is all very complicated, so we’ll discuss much more about time and its effects on our Futures Thinking framework in-depth in Tenet #11.

Credit Jonathan Greene

TOUCHING ON BLINDSPOTS AND BIASES AT PLAY HERE - PRACTICAL EXAMPLES OF LINEAR AND EXPONENTIAL MINDSETS - THE SAFE CHOICE IS TO ASSUME EXPONENTIALITY

You may have struggled to understand some or most of the ideas put forth in this article. Don’t worry, it’s not just a you problem. Human intuitions are not cut out for nonlinearities.

We’ve already touched on the fact that we primarily weren’t raised to properly consider exponents present throughout our lives, content to dwell mainly in Linearland for the majority of our issues—we’ve seen thus far how naive that viewpoint is.

There are other things, natures of the human condition, that limit us from seeing how the world truly is. I’ll discuss many of these more in-depth during Tenet #5, but here’s a quick preview of what’s preventing you from understanding properties of the world you live in:

1) Cognitive biases toward linearity: Our brains evolved to understand immediate cause-and-effect relationships that are often approximately linear over short distances and timeframes. We instinctively extrapolate linearly.

2) Limited time horizons: Human lifespans and historical records cover a tiny fraction of cosmic time. Within short timeframes, even exponential curves can appear linear because we're seeing only a small segment of the curve.

3) Perceptual limitations: Our senses detect relative rather than absolute changes. We notice the difference between 1 and 2 (100% increase) much more easily than the difference between 101 and 102 (≈1% increase), even though the absolute change is identical.

4) Psychological resistance to compounding: We struggle to intuitively grasp how quickly exponential growth accelerates. This is why compound interest is often called the "eighth wonder of the world" - it's powerful but not intuitively understood.

5) Recency bias: We tend to overweight recent events and underweight historical patterns, making long-term exponential trends difficult to recognize.

6) Scale challenges: Exponential systems quickly reach scales that are either too small (quantum) or too large (cosmic) for direct human perception.

7) Narrative thinking: Humans tend to understand the world through linear narratives with beginnings, middles, and ends, rather than through systems of exponential feedback loops.

As you can see, there are many ways that we are naturally or cognitively blind to the exponential portions of the world, prioritizing the linearities of life (and thinking that many of the exponents are actually linear). In the words of Robert Frost, Exponentland would be the “road less traveled,” and Linearland would be the path everyone takes.

Extrapolating this train of thought further, what in our lives would change if we shifted from a primarily linear view to a primarily exponential view?

I asked Claude, AI by Anthropic, to estimate what changes this would make in our lives and it presented the following options (AI text denoted in italics with my commentary in plain text):

1) Decision making and planning

Linear: Plans for steady, predictable progress. Assumes tomorrow resembles today with minor adjustments.

Exponential: Anticipates accelerating change and prepares for dramatic shifts. Consider that next year might be radically different from today.

2) Learning approach

Linear: Acquires specialized skills in established fields, assuming their value remains stable.

Exponential: Develops adaptable meta-skills and embraces continuous learning, anticipating that many skills will become obsolete while new ones emerge rapidly.

Reread those two and see if they sound familiar at all. For me, they sound just like what Carol Dweck writes about in the differences between a fixed vs. a growth mindset, super interesting to see the parallels here. In our learning and decision-making, we can see the parallels between whether we focus on linearities or exponentialities and the resulting trajectory of our actions and mindset.

3) Problem-solving

Linear: Addresses immediate issues incrementally.

Exponential: Seeks leverage points where small inputs can trigger cascading positive effects.

This is a really interesting point of view that leverages the positive elements of exponential curves by looking for the inputs that will cause the right cascading effects throughout the system instead of solving incremental issues as they occur. This could be considered the difference between addressing the symptoms versus targeting the root of the problem (a complicated aside I won’t go into here).

4) Risk perception

Linear: Prepares for predictable risks based on past experiences.

Exponential: Anticipates breakthrough innovations and catastrophic risks that have no historical precedent.

This is a foreshadowing for what we’ll talk about in Tenet #8. The dynamics of risk interplaying with all of these other phenomena create some interesting effects and potentially change our approach to some fundamental issues we’ve potentially always been approaching incorrectly.

5) Time horizons

Linear: Focuses on immediate feedback and quarterly results.

Exponential: Makes seemingly irrational short-term sacrifices for exponential long-term gains.

This emphasizes effects that happen in time vs. over time. The dimension of time adds a layer of complexity that often goes under the radar or is assumed away; however, as a dynamic framework for thought, the time dimension is integral for Futures Thinking.

6) Social impact

Linear: "My individual actions don't matter much in the grand scheme."

Exponential: Recognizes how small actions can cascade through networks, potentially creating exponential impact.

I’ve touched on this idea here and there throughout the series, but I think this is a good place to put some formal thoughts to this idea, specifically leveraging ideas of emergent systems (where the whole is greater than the sum of the parts), wherein we (the parts) create a larger whole (humanity) through our collective actions as a world.

If we all choose to do nothing in relation to a global problem, the whole will amplify those effects, creating exacerbated negativities for all. You’ve seen areas of the world where there is no effort put into trash collection or disposal (multiply that by an entire world). The inverse is true: if we all choose to do something, the whole will amplify those effects, elevating the world more than ever before.

This is the whole rationale behind all the campaigns and slogans you learned in elementary school: “reduce, reuse, recycle”, “say no to drugs”, “sharing is caring”, and the entirety of the cleanup song (you know the one).

These actions, if we all take them, could do more to change the world than many political actions or otherwise positive intentions.

To conclude, the small yet powerful differences present between linear thinking and exponential thinking emphasize the need to address our underlying mindset of how the world is set up. We learned from a young age that the world is linear; however, that mindset has limited upside and unlimited downside, leaving us vulnerable to foreseeable exponential blind spots.

The key change is to recognize the exponentiality present in the world, an exponentiality we tend to overlook or underrepresent. To reiterate a previous point, it’s much safer to assume exponentiality than linearity.

Congrats, we’ve made it through Tenet #3. Hope you enjoyed it. Please give me any feedback you have—happy to clarify or elaborate further on anything discussed.

In future articles, we’re going to dive deeper into the ramifications of these complex, interconnected systems, starting with Tenet #4:

The future is majorly—if not entirely—uncertain.

That’s all for today. I’ll be back in your inbox on Saturday with The Saturday Morning Newsletter.

Thanks for reading,

Drew Jackson

Stay Connected

Website: brainwaves.me

Twitter: @brainwavesdotme

Email: brainwaves.me@gmail.com

Thank you for reading the Brainwaves newsletter. Please ask your friends, colleagues, and family members to sign up.

Brainwaves is a passion project educating everyone on critical topics that influence our future, key insights into the world today, and a glimpse into the past from a forward-looking lens.

To view previous editions of Brainwaves, go here.

Want to sponsor a post or advertise with us? Reach out to us via email.

Disclaimer: The views expressed here are my personal opinions and do not represent any current or former employers. This content is for informational and educational purposes only, not financial advice. Investments carry risks—please conduct thorough research and consult financial professionals before making investment decisions. Any sponsorships or endorsements are clearly disclosed and do not influence editorial content.