Mergers & Acquisitions

From An Economist's Viewpoint

Hello!

Thank you for reading the Brainwaves newsletter. I’m Drew Jackson, your content curator, and today I’m writing about companies merging with and acquiring other companies. Let’s dive in.

Before we explore today's topic, a quick reminder: Brainwaves is published every Wednesday, covering a range of subjects including venture capital, economics, space, energy, intellectual property, philosophy, and more.

I'm not an expert, but rather an eager learner sharing thoughts along the way. I welcome feedback, differing viewpoints, and healthy discussions that expand our horizons. If I make mistakes, please feel free to politely clarify or correct me.

If you enjoy this newsletter, please share it with friends, colleagues, and family. Now, let's delve into this week's topic.

Credit Credo Higher Ed

Thesis: Companies are merging with and acquiring other companies all the time. Why? What’s the reasoning behind these million- or billion-dollar decisions? Many common explanations used to rationalize these mergers/acquisitions aren’t economically viable, so how can you go about creating value through these transactions? How much value is created? By breaking the concept of mergers/acquisitions down to its fundamentals, we can see how the value created depends on the M&A price premium.

Mergers & Acquisitions

Mergers and acquisitions (M&A) are key parts of the economy, allowing businesses to consolidate, grow, and eventually form pseudo-monopolies. Mergers and acquisitions are also key parts of the competitive landscape as they provide a mechanism (along with bankruptcy) to limit the number of firms in an industry. Some people use M&A activity as a sign of overall economic health.

You’ve probably heard of companies merging or being acquired in the news, but have you ever wondered why it’s happening?

A large portion of the high-finance industry is dedicated to helping companies merge and acquire other companies. It’s a very lucrative business. These people get paid millions of dollars to facilitate these transactions. But how? Is there that much money to be made simply by companies buying and selling other companies?

Let’s go one step further. There is a whole industry called Private Equity, whose sole purpose is to buy and sell other companies and is a major player in the M&A industry. There must be something they’re doing with buying and selling companies that are creating immense profits. What methods are they using and how does it work?

Today, my goal is to answer all of these questions and more.

Credit National Association of Corporate Directors

M&A Economics

Mergers and acquisitions are commonly lumped together, yet they are slightly different. Think of it this way: A merger is when a $100M company combines with another $100M company to form a $200M+ company. An acquisition is when a $1B company buys a $100M company to form a $1.1B+ company.

The key difference between the two is a merger is companies of the same or similar size and an acquisition is a big fish buying a little fish.

Now, there are different types of mergers and different types of acquisitions, depending on the scenario.

For mergers, there are pure conglomerates, mixed conglomerates, horizontal mergers, product extension mergers, vertical mergers, forward triangle mergers, and backward triangle mergers.

Pure Conglomerates: A merger between two firms that are in two totally unrelated industries that have nothing in common. For example, Pepsi merges with Nike.

Mixed Conglomerates: A merger between two firms that are in two totally unrelated industries that are looking for product extensions or market extensions. For example, Merck merges with Premier Protein as it looks to enter the entire “personal care” segment.

Horizontal Mergers: A merger between two companies in the same industry. This can also be referred to as a business consolidation or industry consolidation. These companies are usually competitors offering similar, if not the same, products or services. For example, if Pepsi and Coca-Cola merge.

Market Extension Mergers: A merger between two companies that deal in the same products but in separate markets. For example, if the MLS merged with the Premier League.

Product Extension / Cogeneric Mergers: A merger between two businesses that deal in different products that are related to each other and operate in the same market. For example, a merger between Credit Karma and Intuit.

Vertical Mergers: A merger between two companies producing different goods or services for one specific product. For example, a tire company merges with an engine company to supply car manufacturers.

Forward Triangular Mergers: When a merger is used to complete an acquisition and a subsidiary is formed, and in the end, the subsidiary survives and the target disappears (this one is complicated, so for our purposes today I’m going to ignore it).

Backward Triangular Mergers: When a merger is used to complete an acquisition and a subsidiary is formed, and in the end, the target survives and the subsidiary disappears (this one is complicated, so for our purposes today I’m going to ignore it).

For acquisitions, there are pure conglomerates, mixed conglomerates, horizontal acquisitions, market extension acquisitions, product extension acquisitions, vertical acquisitions, share acquisitions & interest acquisitions, and asset acquisitions.

Pure Conglomerates

Mixed Conglomerates

Horizontal Acquisitions

Market Extension Acquisitions

Product Extension Acquisitions

Vertical Acquisitions

Share Acquisitions & Interest Acquisitions: An acquisition where one company acquires all or a majority interest in the stock of a company by buying the shares from the shareholders. For example, Apple tries to acquire McDonald’s by buying all of its shares in the stock market.

Asset Acquisitions: An acquisition where a business acquires all or a majority of the assets a company owns, but not its business altogether. The target company does not become a subsidiary of the acquirer in this scenario. For example, Apple buys all of the real estate McDonald’s owns.

Are you lost yet?

For our purposes today, it’s more than fine to revert back to the original definitions of mergers and acquisitions in a broad sense ($100M + $100M = $200M+ or $1B + $100M = $1.1B+). Luckily, our goal isn’t to determine and detail all of the minutiae involved in each type of merger or acquisition.

Instead, our goal is to determine the “why” behind each of these—the rationale used to explain each merger/acquisition.

To do this, let’s revert back to some simple economic concepts.

Let’s start with the value of the underlying asset, in this case, the value of the business right here, right now. Let’s keep it simple. Business A makes $10M in profit every year and generates $10M in cash every year. So, would $10M be the value of that business today?

It’s not that easy, unfortunately. That $10M number does not account for the future, specifically, it doesn’t account for the thought that if the business was going to operate like it is today into perpetuity, the owners would be getting $10M each year every year. So, how much is that company worth today if it is able to offer the owners $10M each year?

**Insert an entire industry of financial/company valuation here**

Let’s say, for simplicity, that Business A is worth $100M today. That is to say, if they had 100 million shares of ownership in their business, the value of 1 share today would be $1.

Introduce Business B. For simplicity’s sake let’s just assume Business B is identical to Business A. Business B, like Business A, is also worth $100M today.

Now we’ve established our players and the value of our underlying assets. This is where it gets interesting. You see, the whole premise of mergers and acquisitions is the creation of value. In the finance industry, we like to say 1 + 1 = 3. The whole goal of a merger or acquisition is to try to find how 1 + 1 = 3.

Why? Is there a reason why 1 + 1 can’t equal 2?

Nope. 1 + 1 totally can and does often equal 2. But, in these circumstances, you haven’t created or captured any value, meaning you aren’t better off than you were before.

That is to say, if Business A and Business B merged to create Business AB, valued at $200M, Business AB would not be better off than it was before.

Okay, that might make sense, but how does this CNN headline fit into everything?

Capital One is acquiring Discover Financial Services for $35.3 billion in an all-stock deal, giving the bank a leg up in the competitive credit card market.

Under the terms of the deal announced late Monday, Discover (DFS) shareholders will receive a little over one share of Capital One (COF) for every Discover share they own. That represents an almost 27% premium from Discover’s closing share price of $110.49 on Friday.

Credit Dick Lannister

1 + 1 = 3

Referring back to the article, it states that Capital One is expected to buy Discover for 27% more than the investors in Discover (the shareholders) think they are worth in the open stock market. Discover’s market capitalization was $27.7B, and Capital One is offering to buy Discover for $35.2B.

Why? How are they making money on this deal?

That’s a great question. Simply put, Capital One thinks that 1 + 1 > 2.27, meaning that the combined value of the firm with Discover is greater than the value of Capital One plus Discover plus the price premium.

To put math to this, Capital One thinks this equation is true: Combined Value > Capital One + Discover + Price Premium.

Put another way, Capital One thinks that 1 + 1 = 3.

How does Capital One know that 1 + 1 = 3?

Put simply, they don’t totally know until the deal is done and everything settles. However, they are banking on the fact that their merger/acquisition strategy is sound and will create value from the combined entity.

That poses an interesting question:

Credit Conceptually

Where does this value come from?

Rephrased, this question is just a different form of the initial question posed: Why do companies merge with or acquire other companies?

In this section, I’ll break down commonly cited reasons why companies merge with or acquire other companies, some of which are more economically viable (creating value through the acquisition) than others.

Reason #1: Gain Market Share

Gaining market share is a vague, unspecific reason companies give when trying to rationalize a merger/acquisition. What value does gaining market share actually give to the new combined entity? What value does it create?

Gaining market share could allow you to increase your quantity or raise your prices, but simply gaining market share in itself doesn’t create any additional value.

Reason #2: Reduce Operational Costs

Often called “cost synergies”, reducing operational costs is one of the most common reasons used by private equity and private strategic acquirers. A large portion of bad press regarding mergers and acquisitions comes from reducing expenses immediately after the transaction.

Reducing operational costs refers to consolidating backend operations. For instance, a commonly cited example is if 2 companies merge, they don’t need 2 full accounting departments, so they will keep the best people and let go of the rest, reducing their costs. In many acquisitions and mergers, people are let go all at once, which isn’t the best look, but does help create value in an acquisition.

Reason #3: Expand to New Territories

Geographic expansion doesn’t drive value in an acquisition initially. The way geographic expansion creates value in an acquisition is usually through revenue or cost synergies. For instance, if one software company in Texas merges with one in New Mexico, without anything else, there would be no value created in the merger.

Yet, if the companies were to offer their products to all the customers of the other (cross-selling), they would increase revenue, creating value. If the geographic expansion allowed for further economies of scale when ordering products, this would decrease costs and create value.

Reason #4: Grow Revenues

Growing revenues as a result of a merger or acquisition is a common reason cited as rationale. Revenue can be increased through a merger or acquisition in 2 ways: upsell or cross-sell.

Upselling refers to selling existing customers higher-value products and services. For instance, if clients, on average, purchase $50 each time, upselling would be giving them advertisements for high-value items to boost the average order value to $75.

Cross-selling refers to offering customers complementary products/services in addition to those they are already buying. This would mean instead of just selling them a TV, if you merged with a company offering HDMI cords, you would now sell a bundle of TVs and HDMI cords (for more revenue per order).

Reason #5: Unite Common Products

Companies often use mergers and acquisitions to unite common products/services together into a bundled product/service. This is simply the idea of upselling/cross-selling repackaged.

Reason #6: Increase Profits

Increasing profits is a vague reason why one company would acquire another company. Similar to growing market share, increasing profits doesn’t create value in of itself. Remember the fundamental profit equation:

Profit = (Price - Cost) * Quantity

To increase profit, you have to increase price, decrease profit, or increase quantity. So, one of those is the underlying driver for value creation in a merger. Simply “increasing profit” isn’t a valuable rationale for a merger or acquisition.

Reason #7: Increase Supply-Chain Pricing Power & Other Scale Economies

For many acquisitions and mergers, the larger, combined entity can have more supply-chain pricing power. As they will probably be buying more of each input product, they can negotiate to buy them at a lower price given the larger quantity they are buying, reducing the overall cost of the product.

Other scale economies could also be present in the combined entity, for instance, they could buy a larger machine to produce more quantities at a lower price. They could distribute products on larger vessels for a lower average cost. Either way, scale economies and supply-chain pricing power lead to reduced costs which is how this method creates value.

Reason #8: Eliminate Competition

A commonly cited reason for mergers and acquisitions is to eliminate competition. The rationale people use is that by consolidating the competition, they can subsequently drive up the price and extract more value because consumers have fewer options. For example, if there are only 2 coffee shops in a small town and they merge, the idea is that they could double their prices overnight as consumers could choose to go to the other coffee shop, but their prices would be just as high.

An issue with this is the idea that to purchase your competitor, you have to pay a premium for them. In most markets where the market continues to be relatively competitive after the merger/acquisition, the potential price increase (and gain in profit from this) can be neutralized by the premium paid. Meaning that the premium paid in the merger/acquisition will account for the increase in profitability every year.

Yet, in some rare cases, this strategy works:

For instance, if both companies compete head to head for customers (meaning for those customers they need to offer a lower price since they have multiple options available). If these two companies were to merge, they wouldn’t have to compete for these shared customers, meaning some value is created by charging normal (not discounted) prices to these customers.

In a duopoly setting (where there are only 2 companies providing the good/service), consolidation would form a monopoly—the best form of company for profit maximization and value creation.

Reason #9: Diversification

Some companies acquire or merge with other companies that provide either complementary products or services or completely different products or services. In either scenario, the rationale behind the acquisition could be to provide increased stability to the combined entity as revenue would depend on various streams rather than one.

The purpose of diversification is to increase the likelihood that the company survives and can continue its growth trajectory. Diversification, depending on how it’s done, could also be a source of cross-selling as both companies can share their diverse products and services with each other’s customers.

Reason #10: Tax Benefits

A company may acquire another company that has favorable tax circumstances: substantial carry-forward tax losses, government tax credits, etc. A company that’s highly profitable may choose to acquire another company that isn’t profitable yet but has substantial carry-forward tax losses. After the transaction, the total tax liability of the consolidated company will be much lower than the tax liability of the independent companies.

Another scenario is where a company with a large tax burden acquires another with significant government tax credits previously unused. The combined entity can leverage those tax credits, reducing the overall tax burden.

Either way, achieving tax benefits through a transaction is simply another way of reducing costs (increasing profitability) which is how this method creates value in a transaction.

Reason #11: Knowledge Transfer / Intellectual Property

A common reason for mergers and acquisitions is to acquire proprietary knowledge or intellectual property. Many times a startup is innovating in some way to disrupt the legacy incumbent who then chooses to acquire the startup for its innovative knowledge or intellectual property.

For example, let’s say there’s a small pharmaceutical company that found a cure for cancer and subsequently patented it. A larger pharmaceutical company may choose to acquire them to acquire the patent for the formula.

Yet, technically, simply acquiring proprietary knowledge or intellectual property doesn’t create value in of itself. It’s what the knowledge/intellectual property allows you to do that creates the value. For instance, it may allow you to increase revenue, decrease costs, or increase the quantity of the goods/services it could sell.

Reason #12: Acquire Talent / Cornered Resources

Similarly to acquiring knowledge and intellectual property, companies choose to transact to acquire talent or other cornered resources. Again, these talents/resources don’t create value by themselves, they allow the company to increase revenue, decrease costs, or increase the quantity of the goods/services it could sell.

Reason #13: Increase Financing Capacity

Many large companies that are still in a hyper-growth phase will exacerbate their ability to raise financing (they have too much debt for their size and cannot reasonably acquire more at a reasonable cost). So, these companies may choose to acquire another company that has no debt in order to have that company apply for more debt to fuel their combined growth.

This strategy also has other benefits as the rationale for the merger/acquisition could fit other criteria on this list too (the company could have proprietary tech, a diversified suite of products/services, etc.).

Reason #14: Strengthen Brand

A company may choose to acquire an existing player within their market with a more established, positive brand. Why? Maybe the company hasn’t been in the industry long enough, maybe the company hasn’t effectively established its brand effectively, or maybe its brand may be decreasing in popularity and effectiveness.

By doing this, the combined entity could do all of its business under the positive, established brand name. Granted, this method again doesn’t create any value in of itself, but this increased brand value could allow the company to increase revenue (increase price) or increase the quantity of goods/services sold, therefore creating value in the acquisition.

Reason #15: Increase Network Economies

A company may choose to acquire another company for the purpose of creating the largest network economy in that specific industry. For instance, if the industry leader currently has 75M people on their platform and the next two players have 50M and 40M, the smaller two players may merge to form a combined entity with 90M to become the new industry leader.

Similar to other reasons, this doesn’t create value in of itself, but having the largest network can allow you to increase prices (increase revenue) and increase the quantity of goods and services offered, creating value in the transaction.

Reason #16: Expectation of Short-Term or Long-Term Gains

Many companies, especially larger companies, acquire companies to capture “short-term” or “long-term” gains. That’s an incredibly vague rationale as it emphasizes that they believe their investment will lead to value creation either in the near future or over a longer time horizon. Yet, simply combining the companies does not immediately create this “gain”, other methods (previously touched on and those elaborated below) are necessary to create this gain/value in the acquisition.

Reason #17: Opportunity is Right

Probably the most popular cited reason for a merger or acquisition is that the opportunity has presented itself at the right time. This can be due to a variety of factors. For example, maybe the company has recently undergone a string of bad press releases which have decreased the value of the company significantly. In this case, potentially the company isn’t actually bad or underperforming, it may just have received some bad press for one reason or another, meaning that it could be a perfect time to buy it.

This is one of many examples of how the opportunity may be right for a merger or acquisition, but most reasons involve the company’s purchase price being less than its actual price (the price is discounted for one reason or another).

In these cases, the value is created as the combined entity restores the previous value of the company.

Credit ArentFox Schiff

If you boil down that massive previous list of potential reasons to merge or acquire another company, the list boils down to the following 5 reasons:

Reducing Costs:

Reducing Operational Costs

Increase Supply-Chain Pricing Power & Other Scale Economies

Tax Benefits

Knowledge Transfer / Intellectual Property

Acquire Talent / Cornered Resources

Increase Network Economies

Expand to New Territories

Increase Revenue:

Grow Revenues

Unite Common Products

Eliminate Competition

Knowledge Transfer / Intellectual Property

Acquire Talent / Cornered Resources

Strengthen Brand

Increase Network Economies

Expand to New Territories

Increase Financing Capacity

Increase Quantity Sold:

Increase Financing Capacity

Knowledge Transfer / Intellectual Property

Acquire Talent / Cornered Resources

Increase Network Economies

Expand to New Territories

Increase Chances the Business Survives Longer / Risk Mitigation:

Diversification

Knowledge Transfer / Intellectual Property

Acquire Talent / Cornered Resources

Undervalued Acquisition Target:

Opportunity is Right

______

That’s it. The rationale for mergers and acquisitions, however complicated it may seem, can boil down to 5 economically sound reasons—denoting how value is created in each merger/acquisition:

Reduce Costs

Increase Revenue

Increase Quantity Sold

Increase Chances the Business Survives Longer / Risk Mitigation

Undervalued Acquisition Target

Credit Swiss Gold Safe

M&A Price Premium

Throughout the previous section, I referred to the concept of the “M&A Price Premium”. What does that refer to and how does it relate to the rationale for mergers and acquisitions?

Definition: The M&A price premium refers to the amount a buyer pays above a target company’s current market value when acquiring it.

To paraphrase, it refers to an additional money the buyer pays (over the company’s actual current market valuation). Wait, if the banana only costs $5 why might you pay more than $5 for it?

That’s a great question you may be thinking about concerning the M&A price premium. The reason for M&A price premiums (and other price premiums in the market) relates to the idea of scarcity.

There is only so much of everything. If there’s only 1 banana and it costs $5, the first person may try to buy it for that. Yet, a second person may come by and offer $6, and so on. In a competitive, capitalist market, the seller of the good would entertain bids (via an auction process) until he had received the highest bid possible.

Why? It all relates back to the simple concepts of supply and demand. In our bad example, there exists only one banana in the market, so it would make sense the 1 person who would pay the highest for this banana would receive the good. If there were 2 bananas, the 2 people who would pay the highest price for the bananas would continue bidding for them until it was only them left, eventually paying the 2nd highest bid price. If there were 3 bananas, the 3 highest bidders would get the bananas, paying the 3rd highest bid price, and so on.

So, relating this back to mergers and acquisitions, when there’s only a supply of 1 company, the top bid may need to be above relative market value, reflecting the scarcity of the good. What is this bid determined by?

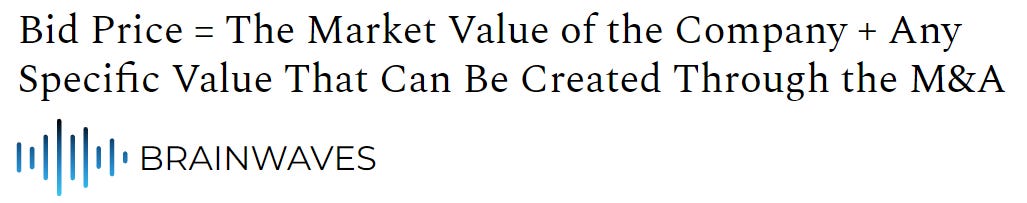

The bid price is determined by the following equation:

For each company looking to acquire the company, this bid price equation will result in a different value. For instance, if the market value of the company is $100 and your company thinks that it can create $20 of value through the acquisition (1+1 = 3, see the rationale in the sections above), then they would bid up to $120. In this scenario, if there was only 1 other bidder and they think they can create $50 of value through the acquisition, they would bid up to $150, meaning they would win the bid at $121. In this example, the M&A price premium would be $21 ($121 paid - $100 market value).

Okay, but how does the M&A premium relate to the rationale for mergers and acquisitions?

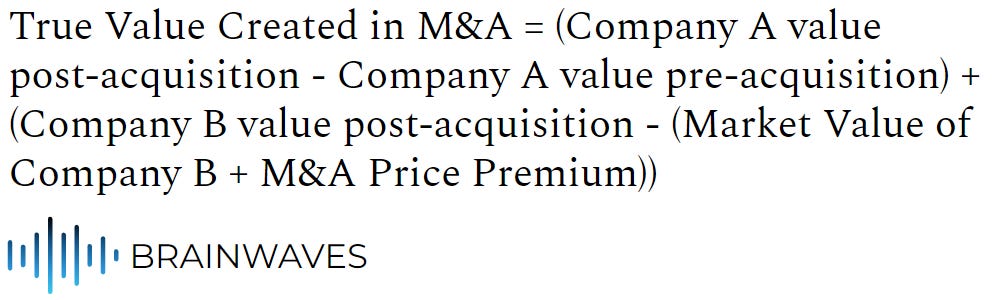

Let’s define a new term: “True Value Created in a Merger/Acquisition”

The “True Value Created in a Merger/Acquisition” refers to the actual value realized by the combined entity after any costs occurred in the merger. Let’s put it into equations with Company A acquiring Company B to create Company AB:

That’s super complicated, so let’s break it down into parts. The first part “Company A value post-acquisition - Company A value pre-acquisition” refers to the change in value for Company A before and after the merger. For example, if Company A had a bad brand and chose to acquire a company with a better brand, Company B. In this case, let’s say Company A (pre-acquisition) was $100 and the value post-acquisition was $200. So, the change in value due to the acquisition for Company A was $100.

Part 2 of the equation “Company B value post-acquisition - (Market Value + M&A Price Premium)” is slightly more complicated. Let’s combine the values in the parenthesis to be the “Price Paid for Company B” or the bid price (as the bid price we just learned was the market value + M&A price premium. So our new equation would look like:

So, part 2 of the equation “Company B value post-acquisition - price paid for Company B” now refers to the value of Company B once integrated with Company A (to become Company AB) minus the price we had to pay to get that value. Continuing our example, let’s say that Company B has a very valuable reputation in the industry and is highly sought after. In this case, let’s say Company B’s value post-acquisition was $100, but we had to pay $150 (a market value of $100 + an M&A price premium of $50) to acquire the company. So the net value of Company B is -$50.

So, what is the “True Value Created in a Merger/Acquisition” in our example?

Company A change = $100. Company B net = -$50. So total value created in our example is $50.

______

Another way to write our equation (which will be helpful for the next section) is the following:

This is nice, but how does this help us understand how the M&A price premium affects value created in an acquisition?

Let’s make some assumptions:

Let’s assume, all else equal, that the value of Company AB = Value of Company A pre-transaction + Value of Company B pre-transaction + Expected Value Created Through the Merger.

So, integrating this into our equation (plugging in this new equation for Company AB), we get the following:

Substituting “Expected Price Paid for Company B = Company B value pre-merger + Expected M&A price premium” we end up with the following equation:

Since we know companies only will merge with or acquire another company if there is actually value created, we can create the following inequality from our equation:

Simplifying to:

So, applying our rationales from above, the expected value created through the merger (either through increased revenue, increased quantity, reduced cost, increased chance of survival, or undervalue of the company) must be greater than the price needed to be paid to acquire this value or else the merger/acquisition isn’t value creating.

This notion hits home the idea that the M&A price premium erodes quite a bit (if not most/all) of the value created/realized in the merger/acquisition. This is why most mergers/acquisitions fail: value is expected to be created through the acquisition, yet the price needed to be paid to acquire this value is more than the value being created.

So, to take this half a step further, this notion also explains why companies choose to acquire/merge with the companies they do:

Companies merge with/acquire companies where the expected value created through transaction will be more than the price needing to be paid to acquire this value. When evaluating potential merger/acquisition opportunities, simply evaluating the expected value created minus the price premium will determine whether the merger/acquisition creates value and should therefore be pursued.

It’s as simple as that.

Credit Pinnacle Pharmacy Group

Why Should You Care About Mergers/Acquisitions?

Many of you will be involved in a merger/acquisition sometime during your career. As you can see, there is a variety of different reasons for why that merger/acquisition is happening. Understanding what this potential rational may be can help you understand what may happen to you and your business after the merger/acquisition.

For instance, if value expected to be created through the merger/acquistion is via reducing costs, there’s a decently high likelihood your job may be at risk. Instead, if the value is expected to be created through increasing revenue, there’s a decently high likelihood you’ll need to understand how to sell the other company’s products to your customers (and vice versa).

Yet not everyone will be involved in a merger or acquisition during their career, so why should you care?

Mergers and acquisitions affect more of our lives than we expect. As most, if not all, of the largest companies you’re familiar with were created and grew through mergers/acquisitions, your life has been shaped by mergers/acquisitions more than you know. For instance, these companies may have merged to offer a lower-priced product, one you choose to now purchase over your old choice.

Understanding how and why mergers and acquisitions happen can each consumer, employee, and business owner understand current events, understand pricing and supply of products, understand market dynamics and the competitive landscape, and overall understand the economy more. That’s a lofty statement, yet there’s a reason why there’s a $100B+ industry just based on helping companies merge and acquire each other.

So, the next time you see a merger/acquisition announced in the news, think about what rationale they might be using, where the value is being created, and overall how life will change because of it.

See you Saturday for The Saturday Morning Newsletter,

Drew Jackson

Twitter: @brainwavesdotme

Email: brainwaves.me@gmail.com

Submit a topic for the Brainwaves newsletter here.

Thank you for reading the Brainwaves newsletter. Please ask your friends, colleagues, and family members to sign up.

Dive deeper into Venture Capital, Economics, Space, Energy, Intellectual Property, Philosophy, and more!

Brainwaves is a passion project educating everyone on critical topics that influence our future, key insights into the world today, and a glimpse into the past from a forward-looking lens.

To view previous editions of Brainwaves, go here.

Want to sponsor a post or advertise with us? Reach out to us via email (brainwaves.me@gmail.com).

Disclaimer: The views expressed in this content are my own and do not represent the views of any of the companies I currently work for or have previously worked for. This content does not contain financial advice - it is for informational and educational purposes only. Investing contains risks and readers should conduct their own due diligence and/or consult a financial advisor before making any investment decisions. Any sponsorship or endorsements are noted and do not affect any editorial content produced.