The Saturday Morning Newsletter #17

Government Contracts, Bezos, the Universe, Insurance, Wealth, and More

👋 Hello friends,

Thank you for joining this week's edition of The Saturday Morning Newsletter. I'm Drew Jackson, and today we're exploring 11 articles, essays, companies, ideas, podcasts, videos, or thoughts that caught my attention this week for their potential to significantly impact our future.

Before we begin: The Saturday Morning Newsletter by Brainwaves arrives in your inbox every Saturday, a concise and casual digest of current events, optimistic news stories, and other interesting tidbits about venture capital, economics, space, energy, intellectual property, philosophy, and beyond. I write as a curious explorer rather than an expert, and I value your insights and perspectives on each subject.

Time to Read: 6 minutes.

Let’s dive in!

NPR: Artificial Intelligence Wants to Go Nuclear. Will it Work?

For decades, Silicon Valley’s ethos has been to go fast and break things. This has worked in many scenarios, specifically regarding low-risk tech investments. However, some other ventures haven’t been as promising (Theranos, we’re looking at you). Nuclear power, historically, has a reputation for moving extremely slowly because we can’t afford a break.

What happens when a proverbial unstoppable force meets a proverbial unmovable object? Strap in and get out the popcorn, for one of these sides needs to back down (nuclear people are betting that it’ll be tech, and tech people are betting it’ll be nuclear).

Canadian Climate Institute: Strengths and Cautions of Onshore Wind Energy

The Canadian Climate Institute believes that onshore wind is a “safe bet”. They cite 3 strengths and 1 caution about onshore wind. Strength #1: A proven, mature technology with a well-established supply chain. Strength #2: The cheapest source of new electricity today in many jurisdictions. Strength #3: A central pillar of Canada’s clean energy transition. Caution #1: Slow project siting and approval processes.

Science | Business: Widening Countries Look to Steal a Lead in Next-Generation Nuclear Power Stations

European countries have a high contrast when it comes to nuclear energy. Some countries, like Germany and Belgium, are phasing out nuclear power. Other countries (ones with a historical record of being large producers) are laying plans to deploy small modular reactors (SMRs), one of the first efforts to put SMR plans in the works.

NOAA Fisheries: Offshore Wind Energy: Assessing Impacts to Marine Life

What are the potential ecological impacts of offshore wind?

Changing the soundscape could adversely impact fish, marine mammals, and other ocean species

Offshore wind turbines could introduce electromagnetic fields that could impact fish navigation, predator detection, communication, and the ability for marine life to find mates

Local wind turbines could alter hydrodynamics, potentially changing these ecosystems

Offshore wind turbines could create a “reef effect” where marine life clusters around the hard surfaces of the turbines

Wind turbines could possibly lead to more vessel strikes

Ocean corrosion protection systems could release contaminants

Reuters: US Offers Six Companies Contracts to Make Uranium Fuel for Nuclear Plants

The United States Government is betting big on domestic nuclear energy. $2.7B worth of big. This week, 6 companies were awarded contracts to begin domestically mining and producing HALEU nuclear fuel: General Matter, Global Laser Enrichment, Louisiana Energy Services, Laser Isotope Separation Technologies, Orano Federal Services, and America Centrifuge Operating. The total value of these combined contracts over the coming years could be up to $2.7B (a very large sum, especially when only divided 6 ways).

Electrek: The US’s Largest Solar + Storage Project Gets the Green Light

Oregon regulators just approved a 2.4 GW solar and storage project by Sunstone Solar, the biggest US project to date. Many renewable projects have been receiving priority green lights from friendly regulators before the new administration begins next month. Until now, the United States energy transition, especially when it comes to solar energy, has been growing quickly, a trend expected to dampen in the coming months.

The New York Times: Jeff Bezos Prepares to Close the Gap in His Space Race With Elon Musk

Elon Musk and Jeff Bezos are continuing their space race, with Bezos picking up speed with Blue Origin’s New Glenn rockets. These rockets are going to be used to power Amazon’s Project Kuiper, a network of satellites that will provide internet access from space (very similar to SpaceX’s Starlink). It seems like Bezos is just following the SpaceX playbook for now.

Live Science: James Webb Telescope Confirms We Have No Idea Why the Universe is Growing the Way It Is

In 2019, the Hubble Telescope suggested that a fundamental assumption scientists had about the universe could be untrue. Now, in 2024 the James Webb Space Telescope has cemented this observation, that the universe expanded at different speeds across varying stages of its lifetime.

"The more work we do the more it is apparent that the cause is something much more interesting than a telescope flaw. Rather it appears to be a feature in the universe," lead study author and Nobel laureate Adam Riess, professor of physics and astronomy at Johns Hopkins University.

Space News: America Must Win the Race for Space Solar Power — or Buy it from China

The premise of this article seems to be a little too extreme in my opinion. “Unless America acts soon, we may find ourselves buying this game-changing capability from Beijing rather than developing it for ourselves.” That assumes that the United States will need more energy than it can domestically produce and that the only solution to this issue is to get space solar power from China. Is that really going to be the case? Probably not, but it’s interesting to highlight the growth in Chinese capabilities.

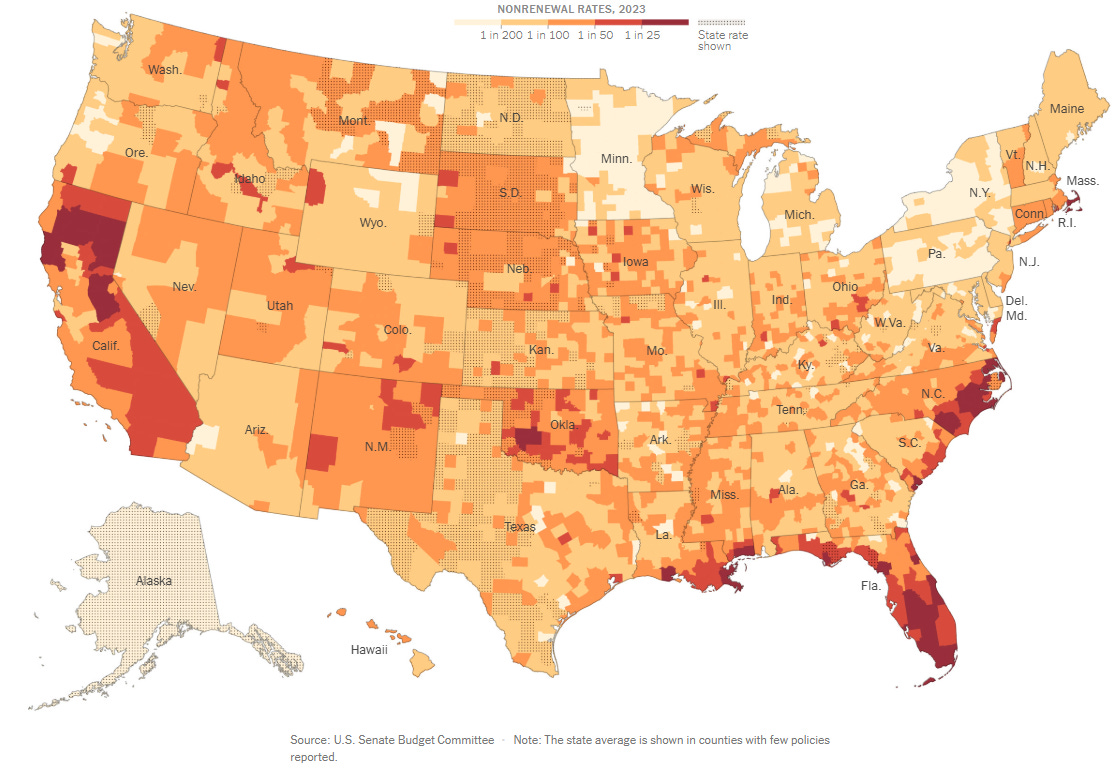

The New York Times: Insurers Are Deserting Homeowners as Climate Shocks Worsen

Since 2018, insurance companies have “nonrenewed” the contracts of more than 1.9M homes (in layman’s terms, they dropped coverage). Due to climate change shocks, the home insurance market has become more volatile. The following graph is from data released in the Congressional report this week:

To quote the article, “The consequences could be profound. Without insurance, you can’t get a mortgage; without a mortgage, most Americans can’t buy a home. Communities that are deemed too dangerous to insure face the risk of falling property values, which means less tax revenue for schools, police, and other basic services. As insurers pull back, they can destabilize the communities left behind, making their decisions a predictor of the disruption to come.”

If you’ve never read an article or research discussing generational wealth, specifically how it is transferred generally via homes, it’s worth a read. Here’s a recent one I read this week from Yahoo Finance.

The idea is that the median net worth of a homeowner is much more than that of a renter. Why? There are many reasons. Here are some of the main ones I’ve heard:

A lot of people capable of owning their own home have received generational wealth to help pay for the downpayment or the mortgage over time.

People capable of owning a home / being qualified for a home mortgage loan have a different financial/lifestyle/career profile than those who rent (generally higher credit scores, higher savings, higher investments, higher salaries, etc.).

People renting are often in a transitionary period and are often at the beginning of their adult lives (not always however, but I believe the median age of a renter is probably lower than that of a homeowner), and therefore they will have had less time to build up wealth.

To use the numbers from the article, the median homeowner in the US has a net worth of $400k, whereas the median renter has a net worth of $10k. That’s a huge difference!

Why is this the interesting thought of the week?

Great question. Firstly, I just think it’s a cool concept to consider. But diving a bit deeper into the thought bubble here, I think this concept is more interesting because it is all about perspective. What circumstances are these groups in? What’s making them exhibit these characteristics?

Remember, each of these groups, each of the people that represent and make up these groups are humans just like you or me. They have lives, stories, etc. To sum them up simply by a net worth number is doing them a disservice since there will be millions of circumstances that have impacted them that will not be shown through this simple analysis.

Hopefully you’re thinking a bit more about this concept and acknowledging our differences but in a positive way.

See you Wednesday for Brainwaves,

Drew Jackson

Website: brainwaves.me

Twitter: @brainwavesdotme

Email: brainwaves.me@gmail.com

Submit any interesting articles/links for The Saturday Morning Newsletter here.

Thank you for reading The Saturday Morning Newsletter by Brainwaves. Please ask your friends, colleagues, and family members to sign up.

Disclaimer: The views expressed in this content are my own and do not represent the views of any of the companies I currently work for or have previously worked for. This content does not contain financial advice - it is for informational and educational purposes only. Investing contains risks and readers should conduct their own due diligence and/or consult a financial advisor before making any investment decisions. Any sponsorship or endorsements are noted and do not affect any editorial content produced.